lakewood sales tax filing

Lakewoods approach to economic development is as unique as our community. Returns can be accessed online at Lakewood.

Business Licensing Tax City Of Lakewood

Remember that zip code boundaries dont always match up with political boundaries like Lakewood or Eddy County so you shouldnt always rely on something as imprecise as zip.

. FILE AND PAY SALES AND USE TAX ONLINE - 2018 and later. Remember that zip code boundaries dont always match up with political boundaries like Lakewood or Chautauqua County so you. License file and pay returns for your business.

What is the sales tax rate in Lakewood Washington. The Lakewood New York sales tax rate of 8 applies in the zip code 14750. Remember that zip code boundaries dont always match up with political boundaries like Lakewood or Oconto County so you shouldnt always rely on something as imprecise as zip codes to determine the sales tax rates at a given.

Groceries are exempt from the Lakewood and Washington state sales taxes. For tax rates in other cities see Ohio sales taxes by city and county. That resolves a multistate investigation into claims Intuit misled consumers into paying for online tax preparation services instead of using the companys free service offerings.

15 or less per month. Give feedback about projects and issues. Annual returns are due January 20.

If more than 1000 but less than 30000 in tax will be remitted the Sales and Use Tax Return must be filed quarterly. The Lakewood Wisconsin sales tax rate of 55 applies in the zip code 54138. Platkin today announced a 141 million settlement with the financial software company Intuit Inc.

The minimum combined 2022 sales tax rate for Lakewood Washington is. There is no applicable city tax or special tax. We focus on facilitating appropriate real estate development and.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Lakewood. Businesses that pay more than 75000 per year in state sales tax. You can print a 8 sales tax table here.

800 AM to 430 PM. License file and pay returns for your business. The Washington sales tax rate is currently.

ATTACH all appropriate W-2s 1099s and other Schedules. An alternative sales tax rate of 59583 applies in the tax region Eddy which appertains to zip code 88254. Taxpayers may also check estimates file their current years tax return and upload digital copies of their tax documents such as W-2s or Federal 1040 for both the current year and prior years.

Lakewood OH 44107 216 521-7580. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Taxpayers who wish to pay their quarterly estimated tax bills may do so using this service.

Declaration of Estimated Tax. Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood. 800 AM to 430 PM.

Did South Dakota v. The City of Lakewood requires persons who expect to owe more than 20000 in tax for the current filing year to make quarterly estimated tax payments. For additional e-file options for businesses.

The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales taxThere is no applicable city tax or special tax. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Filing frequency is determined by the amount of sales tax collected monthly.

There are approximately 866 people living in the Lakewood area. Pay water sewer and stormwater utility bills traffic tickets and business tax returns. If your business remits more than 30000 in tax each month the Sales and Use Tax Return must be filed monthly.

Skip to main content. Sales Tax Use Tax. Learn more about sales and use tax public improvement fees and find resources and publications.

If you have more than one business location you must file a separate return in Revenue Online for each location. Learn more about sales and use tax public improvement fees and find resources and publications. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis.

Learn more about transactions subject to Lakewood salesuse tax. The Lakewood sales tax rate is. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax.

The Lakewood New Mexico sales tax rate of 59583 applies in the zip code 88254. Get Involved - Stay Informed. The Colorado sales tax rate is currently.

The Small Glories come to Lakewood for a cant miss night of Americana and Canadian roots music. There are approximately 3950 people living in the Lakewood area. An alternative sales tax rate of 8 applies in the tax region Ellicott which appertains to zip code 14750.

The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales tax and 340 Lakewood local sales taxesThe local sales tax consists of a 340 city sales tax. Joint Allocation Form. Lakewood Municipal Code 301020 Definitions Price or Purchase Price Sales Tax Use Tax 301120 Property and services taxed sales tax 301130 Collection of sales tax 301140 Sales tax base Schedule of sales tax 301200 Map or location guide of city boundaries.

Look up 2022 sales tax rates for Lakewood California and surrounding areas. The Sales and Use Tax Return is generally due on the 20th of the month. Get the latest city information.

There are a few ways to e-file sales tax returns. Estimates for the current year are billed quarterly with the exception of the first quarterwhich is due to be paid with your tax return by the April filing deadline. This is the total of state county and city sales tax rates.

20 May 2022 Older Adult. Under 300 per month. The County sales tax rate is.

File your state income taxes online. This is the total of state county and city sales tax rates. Sales tax returns may be filed quarterly.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. Receive Lakewood City News Updates Email Constant Contact Use. Business Licensing Tax.

Please consult your local tax authority for specific. Sales tax returns may be filed annually. The County sales tax rate is.

Individual Income Tax Registration. Tax rates are provided by Avalara and updated monthly. Under an Assurance of Voluntary Compliance.

The Lakewood sales tax rate is. The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month.

Sales and use tax returns are due on the 20th day of each month following the end of the filing period. Acting Attorney General Matthew J. An annual filing basis may also be granted if the monthly tax to be remitted is 1000 or less.

Pin By Angie Iacovetta Milinazzo On Dream Home Real Estate Tips Things To Sell Money Tips

File Sales Tax Online Department Of Revenue Taxation

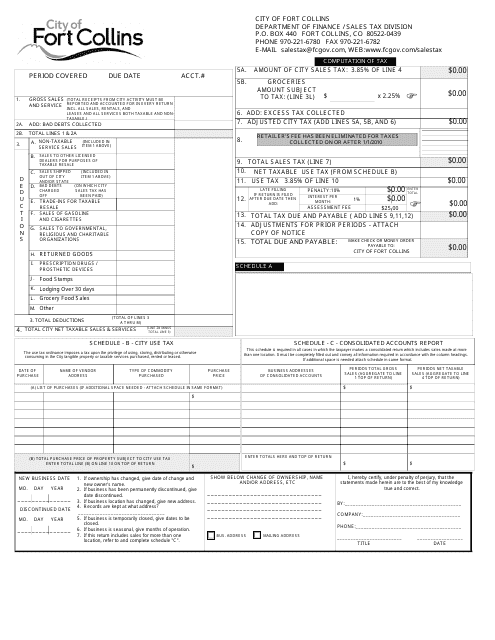

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Pin By Experto Tax Service On Experto Tax Service Small Business Online Small Business Online Business

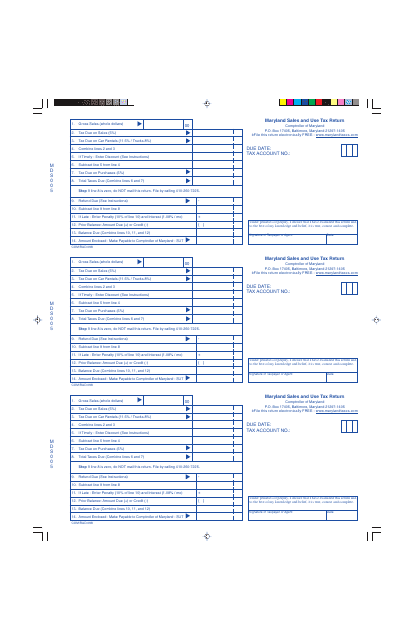

Maryland Sales And Use Tax Return Download Printable Pdf Templateroller

Where Do My Taxes Go H R Block Business Leader Consumer Math Financial Planning

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

Business Licensing Tax City Of Lakewood

How I Filed My Own Itr For The 1st Time One Day Kaye Income Tax Return Filing Taxes Tax Return

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Tax Prep Checklist

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller

Business Licensing Tax City Of Lakewood

Ways To File Taxes For Free With H R Block H R Block Newsroom

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

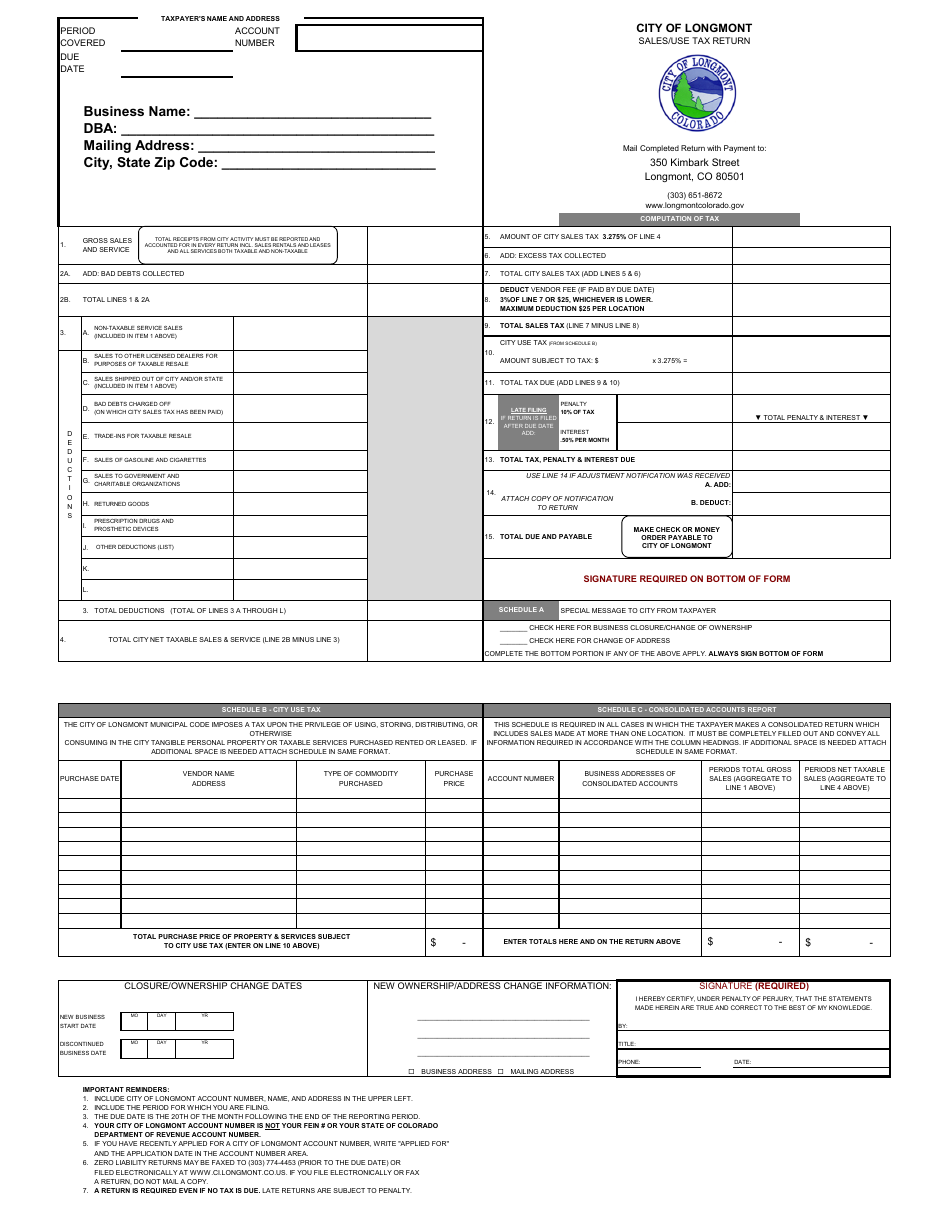

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

What Can You Write Off On Your Taxes From Your Direct Sales Business Taxtime Directsales Savemoney Business Tax Small Business Tax Business Finance

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

The Smarter Way To File Your Taxes Infographic Filing Taxes Tax Refund Infographic